TurboTax user hacked, gets bank account frozen after IRS refund scam: Money Matters. State tax agencies and tax industry continue to fight back against tax-related identity thieves,' the IRS. Here’s what you need to know about tax record hacking. It’s hard not to freak out when you hear that 104,000 U.S. Taxpayers have had their records hacked, making it possible for thieves to file fake tax returns and possibly even steal your refund.

TurboTax

Bottom Line

TurboTax is the top-selling online tax preparation software suite in the U.S. The company offers a wide range of tax services, including the option to file federal and state returns for free, self-employment and business returns, and even the option to work one-on-one with a certified tax expert. With its best in class online products, TurboTax is an affordable place to file your own taxes.

Pros

- Best-in-class Technology

- Great customer support

- Easy to upgrade

- Saves you time if you use it every year

- Useful for almost all tax situations

10.0

9.0

9.5

9.0

9.5

TurboTax is owned by Intuit, which is a massive accounting and tax services firm that employs over 9,000 people worldwide. Suffice to say that TurboTax is not your typical mom-and-pop tax accounting firm; Intuit generated nearly $7 billion in revenue in 2019.

This post is going to review everything that TurboTax has to offer, including its range of tax filing options, the pros, and cons of using these services, and more.

TurboTax Online Products

TurboTax is well known for advertising-free tax filing services. In fact, this feature is plastered all over their website.

As I’ll explain in this post, the “FREE Guaranteed” slogan is a little misleading. It turns out that there are several different ways that you might wind up having to pay to complete your returns.

But, it depends on your filing requirements and which product you use. Let’s dig in to each:

TurboTax Free Edition

With the TurboTax Free Edition, simple tax returns can be filed for free. This means that, in theory, you’ll pay $0 to file federal and state taxes.

In reality, there should be a large asterisk next to the word free as you’ll soon see. With that in mind, in order to actually qualify for the free edition, your tax situation must meet the following conditions:

- W-2 income only. If filing your taxes requires forms beyond a standard W-2, you’ll have to pay to do your taxes with TurboTax.

- Limited interest income from 1099-INT or 1099-DIV

- Standard deduction only. In order to file taxes for free on TurboTax, you are only able to claim the standard deduction. As such, you might miss out on many potential tax deductions—like charitable contributions and unreimbursed business expenses.

- Earned-income tax credit (EIC). If you qualify for EIC, you can most likely use the Free Edition.

- Child tax credits. If you’re claiming child tax credits, you can most likely use the Free Edition.

On the other hand, you won’t be able to file for free with TurboTax if your tax situation is affected by any of the following:

- Itemized deductions

- Business and 1099-MISC

- Stocks and investment transaction forms

- Rental property income

- Special credits and deductions, such as mortgage interest from form 1098 and student loan interest from form 1098-E, are not able to be filed with the free edition

To get started on your taxes, click the Start for Free button at the top of the page. Well, wouldn’t you know it: After only one click, they’re already pushing the Deluxe Edition! (for a cool $59.99 to boot!).

Next, you’ll be asked some basic questions in an intuitive online sign-up flow. Then, it’s time to register your account.

TurboTax Deluxe

TurboTax Deluxe seems to be the company’s top-selling service.

For a yearly $60 $40 fee, deluxe plan owners can take advantage of the following features:

- Deduction Finder. TurboTax will help you search through over 350 deductions to ensure you’re minimizing your tax liability.

- Guidance for Homeowners. Homeowners can take advantage of important deductions, including mortgage interest and property taxes.

- ItsDeductible. This is an intuitive app that allows you to track charitable contributions throughout the year and then automatically import the donations right into your TurboTax return. This app might come in handy for someone that regularly attends church, for example, and tithes on a weekly basis.

- On-Demand customer support. Deluxe account holders have access to one-on-one customer support should any issues or questions pop up during the tax preparation process.

Wait, you want to file your state taxes, too? You’ll have to fork over an extra $44.99 with the Deluxe product.

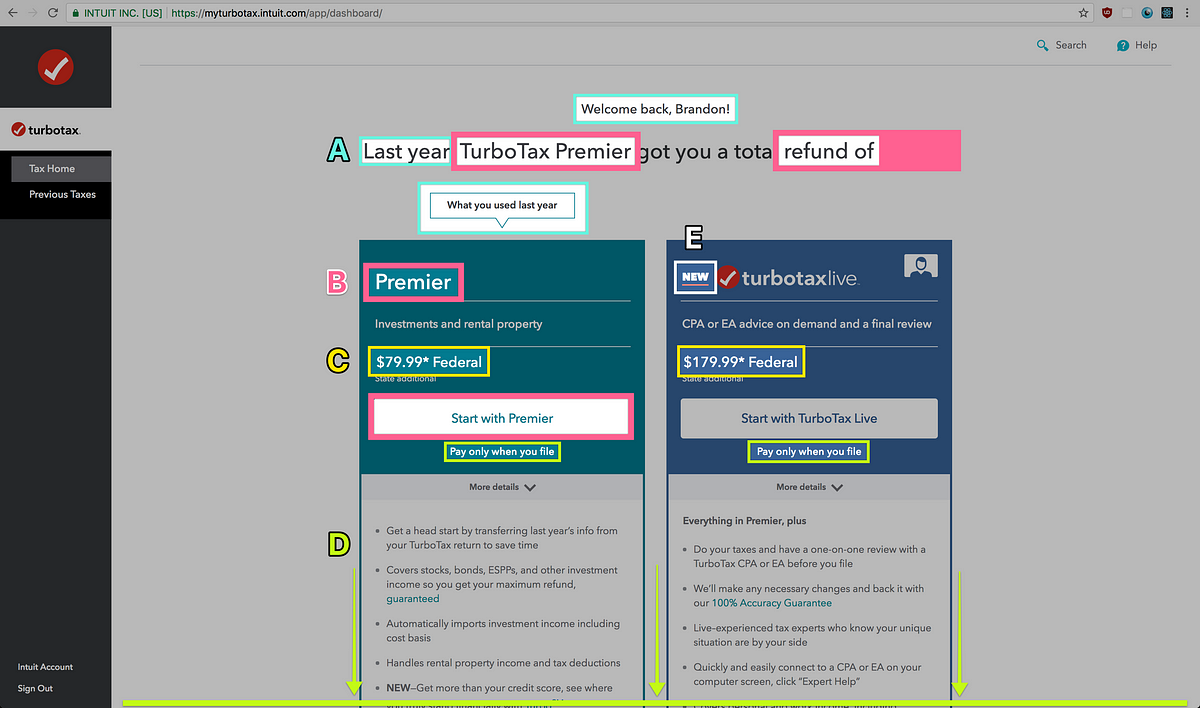

TurboTax Premier

Customers that have more complicated tax situations—including income from investments, rental properties—may want to opt for the TurboTax Premier plan, which costs $90 $70. The premier plan, which includes all of the features of the Deluxe plan, also supports filing cryptocurrency transaction paperwork.

Once you’ve filed your federal return, it costs $50 $40 to file your state taxes.

TurboTax Self-Employed

If you’re self-employed, surprise! You’ll need to sign up for the TurboTaxSelf-Employed plan. This plan costs $120 $90 for federal returns and $50 $40 for state returns.

The self-employed plan includes easy integration with Quickbooks self-employed accounts and offers a wide range of business-specific tax deductions, including vehicle tax deductions, travel and entertainment expenses, and more. In fact, TurboTax will search for over 450 different types of business-specific deductions to whittle down your tax liability.

What’s more, self-employed tax filers will also enjoy the peace of mind of having their return analyzed for any glaring errors that might increase the risk of an audit.

Turbotax Free State Hack

Military Discounts

If you’re an enlisted active duty member of the military or reservist, the TurboTax military discount offers free filing services with any of the TurboTax Online products (Free, Deluxe Premier and Self-Employed editions). This offer is not valid for officers or for any of the TurboTax Live, CD or Download products.

After you enter your W-2, verify your military rank when prompted and your discount will be applied when you’re ready to file.

TurboTax Mobile Apps

TurboTax also offers three unique apps designed to help you manage your taxes more effectively.

1. TurboTax Mobile App

Using the TurboTax Mobile app, you can process and file your taxes right on your mobile device.

This app has an impressive 4.7-star rating (out of 5) in the App Store, with over 240,000 reviews. Not too shabby!

2. TaxCaster

TaxCaster is a nifty tax calculator app that forecasts your (potential) upcoming tax refund while on the go. The app has a 4.0-star rating (out of 5) on the App Store.

3. ItsDeductible

As I briefly mentioned earlier, TurboTax’s ItsDeductible app allows you to keep an accurate record of charitable contributions throughout the year. When it’s time to file your taxes, you can effortlessly import your contribution amounts into your return.

This reduces the chances that you’ll forget about certain donations or make errors on the amounts you’ve donated. ItsDeductible has a near-perfect 4.8-star rating (out of 5) on the App Store. Give it a whirl!

TurboTax Live

If you’d like the added peace of mind of working with a real tax expert—but without having to leave your home or office—you might want to look into TurboTax Live.

There are two versions of TurboTax Live, which we’ll explore next.

TurboTax Live – Assist & Review

With the TurboTax Live Assist & Review plan, you’ll have unlimited on-screen access to a certified tax expert. That individual can answer any questions you might have and give your return a final review before it’s submitted.

TurboTax Live – Assist & Review pricing is as follows:

- Basic returns: $79.99

- Deluxe returns: $119.99

- Premier returns: $169.99

- Self-Employed returns: $199.99

TurboTax Live – Full Service

As the name suggests, with the TurboTax Live – Full-Service plan, a certified tax expert will prepare and file your taxes for you. Phew!

TurboTax Live – Full-Service pricing plans are as follows:

- Basic returns: $129.99

- Deluxe returns: $199.99

- Premier returns: $259.99

- Self-Employed returns: $289.99

TurboTax CD and Download Products

Intuit was offering CD and software-based tax preparation products long before the days of mobile app-based tax preparation. They still offer some of these services today.

TurboTax Advantage

With TurboTax Advantage, you can prepare your taxes on your computer (while not connected to the internet), using the software you’ve downloaded from Intuit.

TurboTax Advantage features are very similar to TurboTax Online, with Deluxe, Premier and Home & Business packages available.

TurboTax Business

If you’re a member of a business partnership, own a C corp or S corp, or are a part of a multi-member LLC, you may want to opt for TurboTax’s Business plan.

This service—which is only available with a CD or software download—costs $169.99 for federal filing and $54.99 for state filing.

TurboTax FAQs

Let’s review some of the most common questions that you might be asking.

Does TurboTax have a free edition?

For very simple tax situations, TurboTax’s Free Edition will let you file federal and state taxes for free. In many other situations, however, you’ll have to upgrade to a paid plan to file your returns.

Since you’re reading my blog, I hope that you already have some solid financial investments in place. If that’s the case, you probably won’t be able to use TurboTax Free Edition (for the reasons I explained above).

Which TurboTax should I use?

It depends on your personal tax situation. If you have one employer, limited investment income, and don’t have a need to itemize deductions, the Free Edition is probably going to be sufficient.

If you’d like to capitalize on itemized deductions, you may want to upgrade to the Deluxe edition. If you traded cryptocurrency within the last year or own a rental property you collect income from, you might want to upgrade to the Premier plan.

If you’re self-employed or are a member of a multi-member LLC, you may be interested in ponying up for the Self-Employed plan or the Business plan. And if you want to communicate with a certified tax expert, you’ll probably want to consider one of the TurboTax Live plans.

Do you have to purchase TurboTax every year?

Yes. You have to pay to file your taxes with TurboTax each year—unless you have a simple tax situation and can use the free edition. Further, if you qualify for the Free File program (more on that in a bit), you won’t have to pay.

What is the income limit for free TurboTax?

If you earn under $34,000 per year, you might qualify for the TurboTax Free File program. If you served as active duty military, are filing your taxes with a military-issued W-2 and earned under $66,000, you’ll most likely qualify for the free file program, too.

Finally, if you qualify for the Earned Income Tax Credit, you might qualify for TurboTax Free File.

TurboTax: Pros & Cons

A quick summary of the benefits and downsides to TurboTax are:

Pros

- Best-in-class technology: Intuit has been in the software game for longer than most millennials have been alive. That said, the ease of use and technology behind their mobile apps and online platforms are second-to-none.

- Convenience: With features such as the ability to upload your tax documents right from your mobile phone, automatic audit-assist, and deduction finder, TurboTax takes a lot of the legwork out of filing your taxes.

- Real Tax Experts Available If Needed: Don’t get me wrong: I’m always a fan of saving money. But when it comes to taxes, it’s often worth the extra investment to make sure you’ve done everything correctly. The last thing you want to do is make a mistake that launches an audit. With that in mind, I like how you can pay a little extra to have your taxes reviewed by a certified tax expert with TurboTax.

- Easy to Upgrade Your Plan: If you’ve already started the tax filing process and then decide you’d like to add additional services, it’s very easy to upgrade your plan. Let’s say you’ve already spent four hours working on your tax return but then realize you have a complicated question that only a tax expert would be able to answer. With TurboTax, you can easily upgrade to a Live plan and then talk to a tax expert. If you started the filing process with a more basic provider -such as FreeTaxUSA, for example— you’d have to start the entire process over again.

Cons

Turbotax Multi State Hack

- Costs More Than Other Services: There’s not a whole lot to complain about with TurboTax—other than the costs. Simply put, TurboTax’s wide array of features and premier technology comes at a premium. Most people will wind up springing for the Deluxe plan—meaning you’ll pay at least $59.99 to file your taxes. Other providers — such as FreeTaxUSA — offer most of the services that come with TurboTax’s Deluxe, Premier and Self-Employed products for free.

So is TurboTax Right for You?

If you’re looking for a one-stop tax shop that can handle almost any type of tax situation, TurboTax is probably a good choice. If you’d like the ability to speak with a real customer support agent or would like the added peace of mind of working with a certified tax expert —and you don’t want to meet someone in person— TurboTax is still probably the right choice.

On the other hand, if you’re looking to save as much money as possible, you might want to look into one of the other free online tax preparation services, such as FreeTaxUSA. Further, if you want to itemize deductions or deduct mortgage interest or property taxes without paying for an online tax filing service, TurboTax likely isn’t for you.

The IRS tax filing deadline of April 15 always seems to sneak up on you. So it certainly makes sense to stay organized and stay ahead of the curve when it comes to filing your taxes online.

If you get things done right, you might be looking at a tax return of several thousand dollars. No matter where you are in your journey to financial independence, that’s a big slice of cash.

After the news of the Anthem hack, this report is really disturbing.

The Salt Lake Tribune:

Fraudsters are using stolen personal information to file fake tax returns for real Utahns, hoping to steal refund money, the Utah State Tax Commission said Thursday.

The commission has identified 28 fraudulent filings so far, but has flagged 8,000 others as potential frauds. It said 18 other states so far have identified similar problems.

[...]

Commission spokesman Charlie Roberts said it found that personal information has been stolen from previous returns filed through TurboTax. He said the commission is not yet sure if other programs and companies were affected, nor if the data was stolen from the cloud or some other means.

TurboTax is a huge enterprise serving millions of individual tax filers. Those most likely to be affected by something like this are the ones who don't have complicated tax returns and are eligible for the Earned Income Tax Credit or other tax refunds.

These security breaches point to the weakness of using Social Security numbers as identity confirmation. With millions of them in the wild, thanks to the hack on Anthem, it's hard to imagine how they serve as a reliable identifier anymore. It's possible that these hacks will serve to drive solutions to identity provenance that doesn't rely on a single number issued by the US government, but it's hard to imagine that happening fast enough to protect those whose identity is currently at risk.

In the meantime, here's some practical advice for you with regard to your tax returns.

- File as soon as you can - The sooner you claim that refund, the better.

- Protect your data - You can't control the servers at TurboTax, but you can protect your own computer. Make sure you've got strong passwords, good firewall protection, and practice safe surfing.

- If you use Quicken, password-protect that data too - Quicken and TurboTax are both Intuit products that link to one another for tax preparation and financial planning and tracking. Make sure you've locked down your data with a strong password on your machine, and don't store it up in the cloud.

I'll post more on this as details become available.

Update: I should have noted in my original post that TurboTax spends millions to lobby for complicated tax returns, because if they were simple, we could just file them directly with the government without the middleman. It appears that they're less diligent about how they guard the data they collect.